Vote “Yes” on Public Question 2

A safe and efficient transportation network is critical to the New Jersey economy, our environment and our quality of life. A “YES” Vote on Public Question #2 on November 8th will guarantee that all revenue from the gas tax is constitutionally dedicated to the Transportation Trust Fund (TTF). A dedicated TTF will provide critical resources to repair and improve our State, County and Municipal roads as well as other transportation infrastructure.

If the TTF is constitutionally dedicated, Trenton will not be able to use your gas tax dollars for any other use except transportation needs.

If Public Question #2 Fails, your gas tax dollars will go to the General Fund and Trenton Politicians will be able to divert these funds for any other use.

A dedicated TTF will create safer transportation infrastructure for commuters and families. The American Society of Civil Engineers has rated New Jersey’s infrastructure a D+ grade. New Jersey needs a dedicated TTF to get back on track. The choice is ours, not Trenton’s. Vote “Yes” on Public Question #2 on November 8th.

Ballot Language

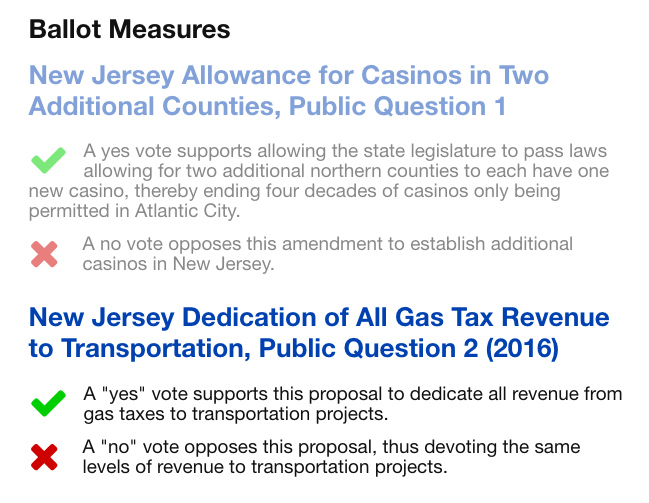

Do you approve amending the Constitution to dedicate all revenue from the State motor fuels tax and petroleum products gross receipts tax to the Transportation Trust Fund?

This amendment would provide that an additional three cents of the current motor fuels tax on diesel fuel, which is not dedicated for transportation purposes, be dedicated to the Transportation Trust Fund. In doing so, the entire State tax on diesel fuel would be used for transportation purposes. The entire State tax on gasoline is currently dedicated to the Transportation Trust Fund and used for transportation purposes.

The amendment would also provide that all of the revenue from the current State tax on petroleum products gross receipts be dedicated to the Transportation Trust Fund. In doing so, the entire State tax on petroleum products gross receipts would be used for transportation purposes.

This amendment does not change the current tax on motor fuels or petroleum products gross receipts.

What does this mean?

This amendment would dedicate all of the revenue from the State tax on motor fuels to the Transportation Trust Fund. The current dedication is 10.5 cents per gallon on gasoline and diesel fuel. The amendment would include an additional three cents of the tax on diesel fuel that is not currently dedicated. The total revenue from the tax on motor fuels this fiscal year is estimated to be $541 million.

The amendment also dedicates all of the revenue from the tax on gross receipts of the sale of petroleum products to the Transportation Trust Fund. The current minimum dedication is $200 million per year. This fiscal year, the revenue from the tax on gross receipts of the sale of petroleum products is estimated to be $215 million.

The amendment does not change the current tax on motor fuels or petroleum products gross receipts. The dedication to the Transportation Trust Fund ensures that the revenue is only used for transportation purposes.

10 Reasons to Vote “Yes”

Facts from the American Society of Civil Engineers, 2016 Report Card for New Jersey’s Infrastructure

1.

Many of the highways in New Jersey were built in the 1950s, and most roads have a maximum life of about 50 years. Many of the State’s roads have now reached the end of their life, and now the need for additional repairs simply to maintain the existing roadway network is evident.

2.

The NJDOT awarded $202 million for pavement projects in 2014, including maintenance and resurfacing projects throughout the State. However, the NJDOT Pavement Management System identified 508 additional deficient pavement sections needing future restoration totaling an estimated $955 million.

3.

Traffic congestion costs New Jersey residents a total of $5.2 billion annually and $861 per driver annually in the form of lost time and wasted fuel.

4.

Forty-two percent of New Jersey’s roadway system is deficient, meaning rough or distressed/cracked.

5.

The average New Jersey driver loses $1,951 annually as a result of driving on deficient roads.

6.

Driving on deficient roads costs New Jersey motorists a total of $11.8 billion annually in the form of additional vehicle operating costs, congestion-related delays and traffic crashes.

7.

Sixty-four percent (64%) of New Jersey’s major urban highways are congested. Population and economic growth in New Jersey have resulted in increased demands on the State’s major roads and highways, leading to increased wear and tear on the transportation system.

8.

Vehicle miles traveled in New Jersey increased by 26% from 1990 to 2012, exceeding 74 billion miles in 2012. By 2030, vehicle travel in New Jersey is projected to increase by another 15%.

9.

Major capacity improvement projects on the New Jersey Turnpike and Garden State Parkway are in coordination with a proposed interchange of I-95 and the Pennsylvania Turnpike Extension in Pennsylvania, which will complete a missing gap in the I-95 corridor that extends north-south along the entire east coast. When I-95 is connected, this should benefit the New Jersey roadway system as truck traffic traveling through the State will no longer be forced onto overly congested highways and local roadways.

10.

The FHWA estimates that each dollar spent on road, highway and bridge improvements results in an average benefit of $5.20 in the form of reduced vehicle maintenance costs, reduced delays, reduced fuel consumption, improved safety, reduced road and bridge maintenance costs and reduced emissions as a result of improved traffic flow.

FAQ

Gas taxes are supposed to go to infrastructure (roads, highways, bridges, transit), but Public Question 2 (Known as ACR1) closes an open loophole that exists for diesel fuel and explicitly places language in the state constitution dedicating motor fuel taxes to infrastructure. In other words, a vote of “yes” puts the gas tax revenue in an account that is constitutionally dedicated to infrastructure and protected from re-allocation or misuse in Trenton.

No. The gas tax increase is a separate piece of legislation. Public Question 2 ensures that all gas taxes and motor fuel revenues are dedicated to infrastructure.

Public Question 2 DOES NOT raise the tax on diesel fuel. There is currently a loophole in NJ law regarding diesel fuel. Right now the tax on diesel fuel is 13.5 cents per gallon but only 10.5 cents of it is dedicated to infrastructure. Public Question 2 closes that loophole and ensures that all diesel gas tax revenue is dedicated to infrastructure.

Tolls from the Garden State Parkway, New Jersey Turnpike, George Washington Bridge, and other tunnels, bridges and roads in the area are used to maintain those specific tunnels, bridges, roads. New Jersey’s location makes it a “pass-through state” for many travelling along the Northeast Corridor from Boston to Washington DC. Tolls and the gas tax are the most effective way to get out-of-state users to pay their share of maintenance and upgrades when traveling through our state.

If you vote no, it increases the chance of Transportation Trust Fund funds and gas tax revenues being used for non-infrastructure projects that should be going towards roads, highways, bridges, tunnels and transit. i.e., Trenton will have the ability to take money from the Transportation Trust Fund to fill a budget shortfall elsewhere in the state budget.

If Public Question 2 passes, then the Transportation Trust Fund and revenue from the gas tax will completely be dedicated to infrastructure improvements.

If Public Question 2 does not pass, then the Transportation Trust Fund and gas tax revenue is at risk of being used by Trenton to fill shortfalls elsewhere in the state budget, which would result in less money for roads, bridges, tunnels, and transit. In turn, this means bumpier rides, more traffic and congestion, and less safe transportation.

As a pass-through state in the Northeast Corridor, NJ sees more than its share of out-of-state travelers, from big trucks on their way to NY, PA, DE, and points beyond, to out-of-staters heading to the Shore in the summertime. If NJ’s roads were maintained though the general fund, then the wear and tear on the state’s infrastructure by out-of-state drivers would be disproportionately paid for by NJ taxpayers.

Additionally, big infrastructure projects are typically multi-year endeavors, and a stable and predictable source of funding helps those projects stay on track.